Digital Service Providers in Kenya Now Regulated By the Central Bank of Kenya

COMPLY OR SHUT DOWN! NEW REGULATIONS FOR NON-DEPOSIT-TAKING MICROFINANCE INSTITUTIONS. The Microfinance Act Number 19 of 2006 had for a long time had to stretch its wings wide enough to address the interests of both the Deposit and Non-deposit taking Microfinance institutions. However, the Central Bank of Kenya; the Key player in the statute and...

Read MorePERFECT MARKET: The Science of Negotiable Instruments.

Negotiable Instruments in Kenya: Understanding Their Role in Business Take, for example, Simon has done some online writing for Peter and upon the day of collecting his payment, he is handed down a paper/document to present before the Finance Department of the organization at a later date in order to get his money, of which...

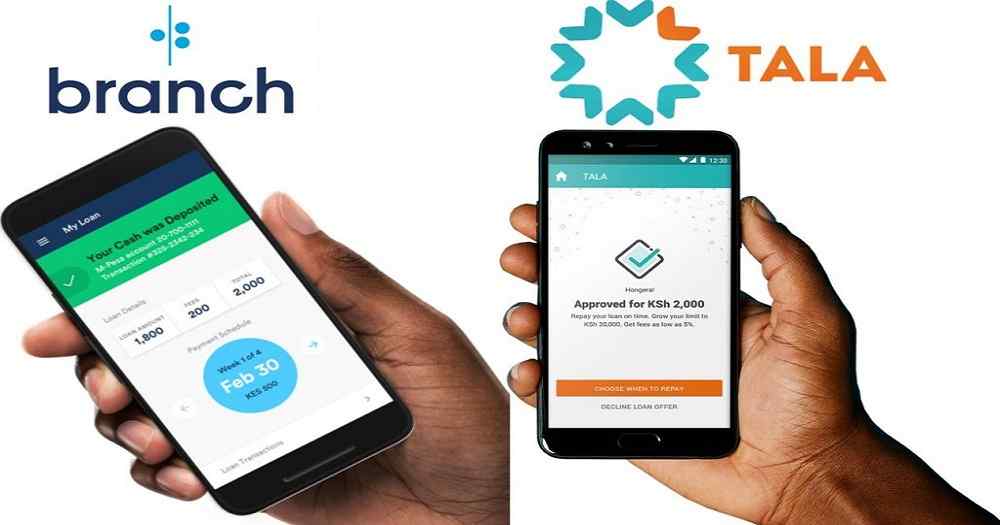

Read MoreSaved By the Bell? An Essential Focus on The Central Bank of Kenya (Digital Credit Providers) Regulations, 2022

Understanding Digital Credit Providers Regulations in Kenya, 2022 Introduction The Central Bank of Kenya’s Digital Credit Providers Regulations, 2022, are reshaping the lending landscape in Kenya. These regulations aim to enhance transparency, protect consumers, and ensure ethical practices among digital lenders. This article dives deep into the key aspects of these rules, their impact on...

Read More